IMPORTANT:- Some links in this article will only be accessible to authorised Members that have logged into the Exchange Trade Centre

Reconciled receipts occur automatically when a payment is received that has the exact same value as the Face Value of a single Traded ETR. The Reserve paid to the Originator is calculated based on the time it takes for a Traded ETR to be Settled (commonly referred to as Day Sales Outstanding [DSO] in accounting terminology). For automatically reconciled receipts, determining the DSO is simply a case of subtracting the Purchase Date from the Payment Date. As explained in the following paragraphs, determining the DSO for payments against multiple ETR is not straightforward.

Frequently, Debtor payments do not match the exact Face Value of Traded ETR. Regularly, payments are intended for multiple Traded ETR and even multiple Debtors. It is neither practical nor plausible to expect Originators to manually reconcile their Debtor balances on a regular basis and/or at a specific time, or day. In the absence of perfectly reconciled Debtor balances, it is important that the Reserve is paid efficiently. Ensuring that the Reserve on every Traded ETR (whether reconciled or not) is paid at the earliest possible time is the governed by the Credebt Exchange® Cash Balance Policy.

The Credebt Exchange® Cash Balance Policy governs the system that calculates the Reserve based on the commonly accepted and recognised accounting principal of First In, First Out [FIFO]. FIFO is typically used to calculate the value of inventory at the end of any specific period and, when adapted for Traded ETR, the FIFO method means that Traded ETR purchased first are Settled/paid first and newer ETR remain unpaid.

Using the FIFO method, the DSO is calculated using the oldest Purchase Date for multiple Traded ETR assigned to a single Debtor payment. Similarly, an Originator remitting a single payment against multiple ETR, payable by multiple Debtors, uses the same method. TARGET2 specifies the number of days in a month and the Reserve for all ETR is consistently calculated as follows:

Reserve = Face Value – (Face Value x RSA x DSO)/30 – Purchase Price*

* For every day that the ETR remains unpaid it is this formula that is used to calculate the reduced Reserve, less any processing commission.

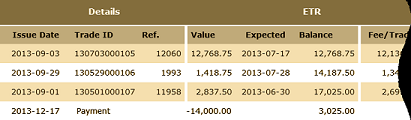

With the Credebt Exchange® Cash Balance Policy ensuring that the oldest Traded ETR are assigned to the oldest payments, the oldest ETR are automatically regarded as Settled and newer Traded ETR are assigned to ending balances. The actual flow of Traded ETR and Settled ETR may not exactly match the FIFO pattern but the balance outstanding against unpaid ETR will always be correct. The following example illustrates the FIFO method used in the Credebt Exchange® Cash Balance Policy:

As an example, a Debtor with three Traded ETR due to be Settled in 90-Days on different Expected Dates, makes a single payment against all three ETR, two of which are paid before their Expected Date. The Settlement Date is the date the payment is identified in the Account Bank. Using the FIFO method for the Purchase Date, the Exchange must use the oldest ETR. This means that in practical terms that although the payment on two of the ETR was before the Expected Date, the Exchange sets the Purchase Date for all three as the same date. Using the Purchase Date set by the Exchange, this is subtracted from the Settlement Date to give the DSO. The Reserve is then calculated based on this DSO. In this example, in real terms it is possible that two of the ETR that were paid early, were calculated as being outstanding for longer than they actually were. If there is an over/under payment to the Originator, this can be adjusted when the Originator submits an agreed reconciliation for the account.

Further details that support this Cash Balance Policy and explain how to read and understand Exchange statements and communicate transactions to the Exchange can be found in the Exchange Reconciliations reference section. The Exchange Transaction Manual is a supporting document that should also be read to gain a complete understanding of Exchange Trading and Settlement policies.