IMPORTANT:- Some links in this article will only be accessible to authorised Members that have logged into the Exchange Trade Centre

Before reading this article, it is important that you download and read the Originator Transaction Manual. To use some of the links provided in this article, you should also login to the Originator Exchange Trade Centre | Dash Board.

In some cases, Debtors do not pay the Credebt Exchange® Account Bank and the Originator must transfer the payment to Credebt Exchange®. When doing so, it is important that the Originator notifies the Trade Desk that this payment has been made. Using the Transaction Update menu option in the Exchange Trade Centre | Dash Board, there are two principal ways to notify the Trade Desk that the Originator has transferred a payment to the Credebt Exchange® Account Bank.

The Exchange Trade Centre | Transaction Update form makes it possible to notify the Trade Desk of two types of payment:

- Payment that is allocated to a Debtor as an A-Trade (until it can be converted to an R-Trade)

- Payment against a specific invoice(s) that is reconciled as an R-Trade

With Specific Allocation

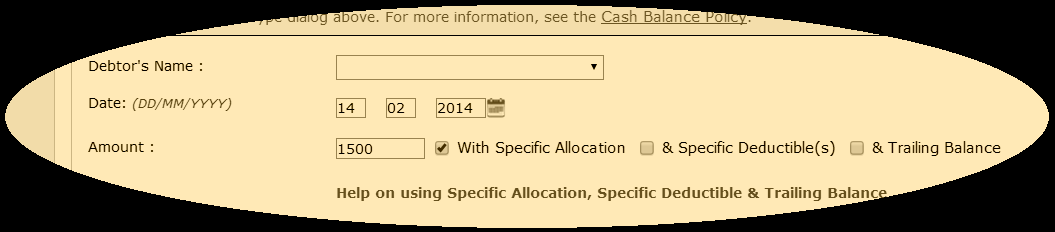

When entering a payment as an A-Trade, the Debtor and the amount of the payment are entered before saving the form. As explained in the Reserve Policy, Reserve payments are only paid against R-Trades. To enter an R-Trade, the Originator checks the ‘With Specific Allocation’ check box. This enables the Originator to then select the specific invoices that the payment is to be reconciled too.

In instances where a single payment from a Debtor does not exactly match specific invoice(s), it can still be entered using with either:

- Specific Deductible; or

- Trailing Balance

Specific Deductible

Specific Deductibles is used if there is an automatic deduction applied by the Debtor. An example might be an agreed trade rebate, or an early payment discount. Depending on your industry sector, such rebates are agreed and applied without the necessity for a specific document, or deduction notice being issued. In these instances, the Specific Deductible(s) check box is used.

For example a payment of 10,000 is made, less a deductible of 2%. In the Amount field 9,800 is entered and specific invoices in the ‘With specific reference to’ text box are selected. The selected invoices will total 10,000 and because the payment received is only 9,800 the ‘Balance’ will show -200.00. In order to process this payment, 200.00 must be entered in the Specific Deductible field on the form. Now that the Balance is 0.00, the form can be submitted.

Trailing Balance

Trailing Balance is used if there is a remittance notification from the Debtor that itemises specific invoices but the amount received does not exactly match the sum total of the invoices indicated. An example might be an over payment, or an payment against an invoice that was not traded on the Exchange. In these instances, the Trailing Balance check box is used.

For example a payment of 10,000 is made, but the invoices being paid only add up to 9,500. In the Amount field 10,000 is entered and specific invoices in the ‘With specific reference to’ text box are selected. The selected invoices will total 9,500 and because the payment received is greater than 9,500 the ‘Balance’ will show 500.00. In order to process this payment, 500.00 must be entered in the Trailing Balance field on the form. Now that the Balance is 0.00, the form can be submitted.